August 20, 2025 by 100XBuilds Team

Tax Deductions for Custom Home Builders: Save $200K+

"My client saved $847,000 in taxes last year using three strategies most builders never consider. The IRS audit? Clean as a whistle." - Senior Tax Partner, Big Four Accounting Firm

When Marcus Thompson's custom home building company hit $8.2M in revenue, his tax bill nearly killed his cash flow. Sound familiar?

Most luxury builders making $5M+ are hemorrhaging money to Uncle Sam because they're stuck thinking like contractors instead of sophisticated business owners. The difference between a $400K tax bill and a $150K one isn't luck—it's strategy.

The Million-Dollar Mistake Most Builders Make

Here's what separates the builders who scale from those who struggle: entity structure optimization.

I've seen too many $10M+ builders still operating as sole proprietors or simple LLCs, paying self-employment tax on every dollar. Meanwhile, their smarter competitors are using sophisticated structures that legally slash their tax burden by 30-40%.

The S-Corp Election Strategy

Converting your LLC to S-Corp taxation can save you $50,000+ annually on a $5M revenue base. Here's the math:

- Traditional LLC: Pay 15.3% self-employment tax on all profits

- S-Corp Election: Pay self-employment tax only on reasonable salary

For a builder netting $500K annually, this election alone saves approximately $45,000 in self-employment taxes.

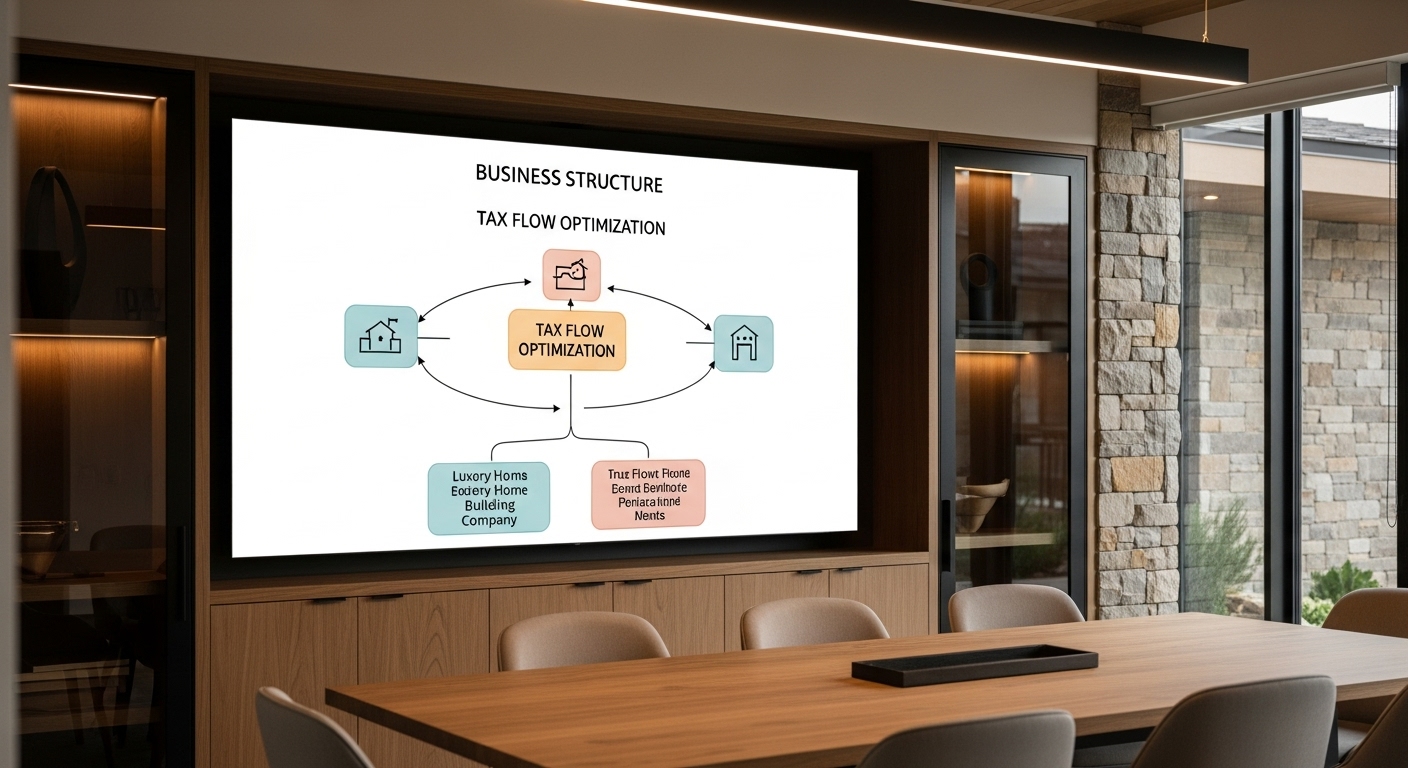

Advanced Multi-Entity Structures

Top-tier builders use holding company structures that separate:

- Operating company (builds homes)

- Real estate holding company (owns land/equipment)

- Management company (provides services)

This separation creates multiple tax optimization opportunities while providing asset protection that keeps personal wealth safe from business liabilities.

Equipment Depreciation: Your Secret Cash Flow Weapon

Most builders treat equipment purchases as simple expenses. Smart builders weaponize depreciation to create massive tax shields while improving cash flow.

Section 179 Deduction Maximization

For 2024, you can immediately deduct up to $1,160,000 in qualifying equipment purchases. This isn't just tools—it includes:

- Construction vehicles and trailers

- Heavy machinery and equipment

- Computer systems and software

- Office furniture and fixtures

Bonus Depreciation Strategies

Even with Section 179 limits, bonus depreciation allows 80% immediate write-off on additional qualifying assets through 2026. A $200K excavator purchase creates a $160K immediate deduction.

The Equipment Timing Game

Purchase and place equipment in service by December 31st to claim full-year deductions. A $100K equipment purchase in December creates the same tax benefit as one made in January—but improves current-year cash flow by $25K-35K depending on your tax bracket.

Cost Segregation: The Builder's Best-Kept Secret

This is where sophisticated builders separate themselves from the pack. Cost segregation studies can accelerate depreciation on completed spec homes and office buildings, creating massive upfront deductions.

Real-World Case Study

A Texas builder completed a $2.8M spec home. Traditional depreciation: $101K annually over 27.5 years. After cost segregation study: $847K first-year deduction.

Components reclassified for accelerated depreciation:

- Electrical systems and fixtures

- Plumbing and HVAC systems

- Flooring and specialized lighting

- Landscaping and site improvements

The ROI Math

Cost segregation studies typically cost $8K-15K but generate $200K-500K in accelerated deductions for luxury builders. That's a 20:1 return on investment in year one.

Strategic Business Expense Optimization

The difference between amateur and professional expense management can mean $100K+ in additional deductions annually.

Home Office Deduction Sophistication

Forget the simplified method. Actual expense method allows deduction of:

- Percentage of mortgage interest and property taxes

- Utilities, insurance, and maintenance

- Depreciation on office portion of home

For a builder with a 400 sq ft office in a 3,000 sq ft home, this typically generates $8K-12K in additional annual deductions.

Vehicle Strategy Mastery

Most builders choose between mileage or actual expense method randomly. Strategic builders analyze both annually and choose the higher deduction:

- Actual expense method: Deduct percentage of all vehicle costs

- Mileage method: 65.5 cents per business mile (2023 rate)

- Heavy vehicle exception: Vehicles over 6,000 lbs qualify for enhanced depreciation

Travel and Entertainment Optimization

Business meals are 100% deductible through 2024 if they meet IRS requirements. Client entertainment at sporting events, golf outings, and industry conferences can generate substantial deductions when properly documented.

Retirement Planning as Tax Strategy

High-earning builders can use retirement contributions as powerful tax reduction tools while building long-term wealth.

SEP-IRA Maximization

Contribute up to 25% of compensation or $66,000 (whichever is less) to SEP-IRAs. For a builder earning $500K, that's a $125K+ tax deduction while building retirement wealth.

Defined Benefit Plans for Maximum Impact

Builders with consistent high income can contribute $200K+ annually to defined benefit plans. These plans work best for:

- Stable income builders earning $300K+

- Limited number of employees

- Owners within 15 years of retirement

Inventory and Work-in-Progress Strategies

Sophisticated inventory management creates significant tax planning opportunities for custom builders.

Completed Contract Method Benefits

For contracts taking more than two years, the completed contract method defers all income recognition until project completion. This allows strategic timing of income recognition for tax optimization.

Materials and Inventory Timing

Strategic material purchases near year-end can accelerate deductions:

- Purchase materials for next year's projects in December

- Take advantage of supplier year-end discounts

- Optimize cash flow while reducing current-year taxable income

Work-in-Progress Valuations

Conservative WIP valuations (within IRS guidelines) can defer income recognition and reduce current-year tax liability. Work with qualified CPAs to ensure compliance while maximizing benefits.

Advanced Strategies for Sophisticated Builders

Conservation Easements

Builders owning development land can potentially claim substantial charitable deductions through conservation easements. These complex transactions require specialized expertise but can generate deductions of 3-5x the actual economic cost.

Opportunity Zone Investments

Reinvesting capital gains into Opportunity Zone funds can defer and potentially eliminate capital gains taxes. Particularly valuable for builders selling appreciated land or completed projects.

Installment Sale Strategies

When selling completed homes or land, installment sales can spread gain recognition over multiple years, potentially keeping you in lower tax brackets and preserving valuable deductions.

Implementation and Documentation Requirements

Record-Keeping Excellence

The IRS expects meticulous documentation for all deductions. Implement systems for:

- Digital receipt capture and storage

- Mileage logs with business purpose documentation

- Time tracking for home office usage

- Detailed project cost allocation records

Quarterly Tax Planning Reviews

Meet with your tax advisor quarterly to:

- Project year-end tax liability

- Identify additional deduction opportunities

- Plan equipment purchases and timing

- Adjust estimated tax payments

Professional Team Assembly

Sophisticated tax planning requires specialized expertise:

- CPA with construction industry experience

- Tax attorney for complex structures

- Financial planner for retirement strategies

- Business attorney for entity optimization

The Cash Flow Impact

These strategies aren't just about reducing taxes—they're about optimizing cash flow for growth. A builder saving $200K annually in taxes has $200K more for:

- Equipment upgrades and technology

- Marketing and business development

- Working capital for larger projects

- Personal wealth building and security

Year-End Action Items

Before December 31st, review:

- Equipment purchase opportunities

- Retirement contribution maximization

- Income and expense timing strategies

- Entity structure optimization needs

The builders who implement these strategies consistently outperform their competitors not just in profitability, but in long-term wealth accumulation and business sustainability.

Ready to slash your tax burden and optimize cash flow? Our financial management specialists work exclusively with luxury builders earning $5M+ annually. We'll conduct a comprehensive tax strategy audit and identify your biggest opportunities for immediate savings.

Schedule your confidential tax optimization consultation today. Because every dollar you save in taxes is a dollar that stays in your business—and your pocket.