August 13, 2025 by 100XBuilds Team

Equipment Financing Strategy: Capital Investment ROI Guide

When Meridian Custom Homes increased their equipment financing by $2.3M over 18 months, their project completion times dropped 34% while profit margins jumped from 12% to 18.5%. The secret wasn't just buying more equipment—it was implementing a capital investment framework that treated every piece of machinery as a strategic asset rather than a necessary expense.

For luxury builders operating at the $5M+ revenue level, equipment financing decisions can make or break your competitive advantage. The difference between builders who scale efficiently and those who plateau often comes down to one critical factor: how strategically they deploy capital for equipment investments.

The Hidden Cost of Equipment Underinvestment

Most construction companies focus on the obvious costs—monthly payments, interest rates, depreciation schedules. But the real financial impact lies in opportunity costs that don't appear on any invoice.

Project velocity impact: Outdated equipment can extend project timelines by 15-25%, directly affecting your ability to take on additional high-margin projects.

Labor efficiency multiplier: Modern equipment can increase crew productivity by 40-60%, effectively reducing your cost per square foot while maintaining quality standards.

Client perception premium: High-end clients expect to see professional-grade equipment on their job sites. Outdated machinery can cost you projects before you even submit a bid.

Maintenance cost escalation: Equipment over 7 years old typically costs 3x more to maintain annually than newer alternatives, creating unpredictable cash flow drains.

Strategic Equipment Financing Framework

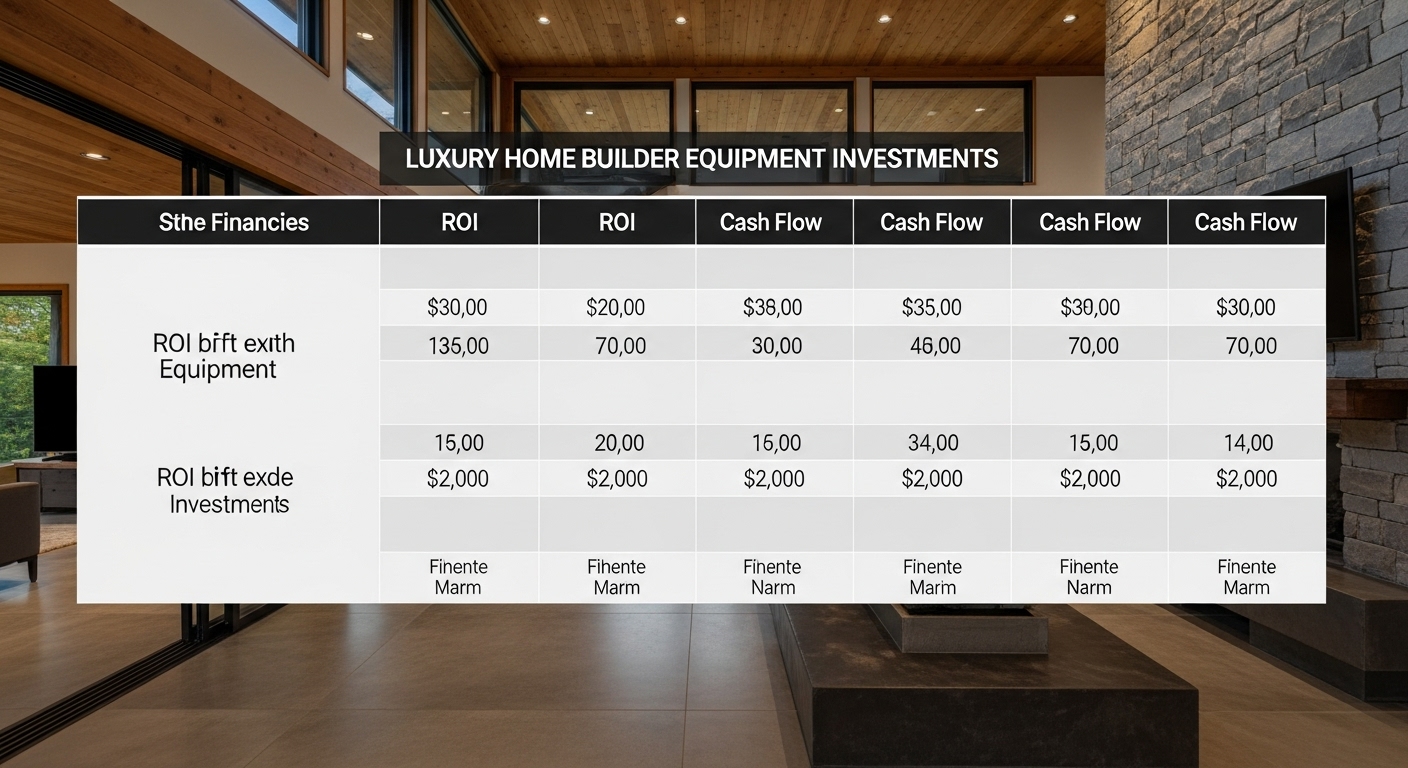

The most successful luxury builders approach equipment financing through a systematic decision matrix that evaluates every potential investment across five critical dimensions.

Revenue Generation Potential

Start by calculating the direct revenue impact of each equipment investment. This goes beyond simple utilization rates to examine how specific machinery affects your ability to win and execute premium projects.

Project capacity expansion: How many additional projects can this equipment enable annually? For excavation equipment, this might mean taking on larger site preparation contracts. For specialized finishing tools, it could open doors to ultra-high-end interior work.

Premium service offerings: Equipment that enables unique capabilities commands higher margins. Builders using advanced concrete pumping systems often charge 15-20% premiums for complex foundation work.

Timeline compression benefits: Calculate the value of completing projects 2-4 weeks faster. For a $2M custom home, early completion can free up capital for the next project while potentially earning early completion bonuses.

Total Cost of Ownership Analysis

Traditional financing decisions focus too heavily on monthly payments while ignoring the complete financial picture. A comprehensive TCO analysis reveals the true investment impact.

Financing structure optimization: Compare lease-to-own, traditional loans, and equipment lines of credit. Many builders find that equipment lines of credit offer the flexibility to scale investments with seasonal demand fluctuations.

Tax advantage maximization: Section 179 deductions can provide immediate tax benefits up to $1.08M for qualifying equipment purchases. Bonus depreciation rules allow additional first-year deductions that can significantly improve cash flow.

Residual value protection: Equipment with strong resale markets provides built-in exit strategies. Caterpillar and John Deere equipment typically retains 45-55% of original value after 5 years, compared to 25-35% for lesser brands.

Maintenance cost predictability: Factor in extended warranty options and service contracts. Predictable maintenance costs improve cash flow forecasting and reduce unexpected capital drains.

Risk Mitigation Strategies

Equipment financing inherently carries risks that can be systematically managed through proper structuring and planning.

Technology obsolescence protection: In rapidly evolving sectors like surveying and project management technology, shorter financing terms (3-4 years) protect against obsolescence while maintaining competitive capabilities.

Seasonal cash flow alignment: Structure payments to match your revenue cycles. Many successful builders negotiate seasonal payment schedules that reduce obligations during slower winter months.

Insurance and liability optimization: Comprehensive equipment insurance should cover replacement costs, not just outstanding loan balances. Gap insurance prevents situations where total loss leaves you owing more than insurance covers.

"We restructured our equipment financing to align with project cash flows, reducing our working capital requirements by $400K while maintaining the same equipment capacity." - Regional Manager, Pinnacle Custom Builders

Financing Vehicle Selection Strategy

The financing method you choose can impact your total investment cost by 20-30% over the equipment's useful life. Each option serves different strategic purposes.

Equipment Lines of Credit

Best for: Builders with seasonal fluctuations or multiple equipment needs throughout the year.

Flexibility advantage: Draw funds as needed, pay interest only on outstanding balances. This structure works particularly well for builders who need different equipment for different project phases.

Cost efficiency: Typically 1-2% lower than traditional equipment loans, with the ability to pay down balances during high cash flow periods.

Credit utilization optimization: Maintain available credit for unexpected opportunities or emergency replacements without lengthy approval processes.

Lease-to-Own Structures

Best for: High-depreciation equipment or when preserving working capital is critical.

Cash flow preservation: Lower monthly payments compared to traditional financing, freeing capital for other growth investments.

Upgrade flexibility: Many lease agreements include upgrade options that keep you current with technology advances without penalty.

Tax optimization: Lease payments are typically fully deductible as operating expenses, providing better short-term tax benefits than depreciation schedules.

Traditional Equipment Loans

Best for: Core equipment with long useful lives and strong resale values.

Ownership benefits: Build equity while using the equipment, with full control over maintenance, modifications, and eventual disposal.

Lower total cost: Despite higher monthly payments, total cost over the equipment's life is typically 10-15% lower than leasing alternatives.

Collateral value: Owned equipment can serve as collateral for future financing needs, providing additional financial flexibility.

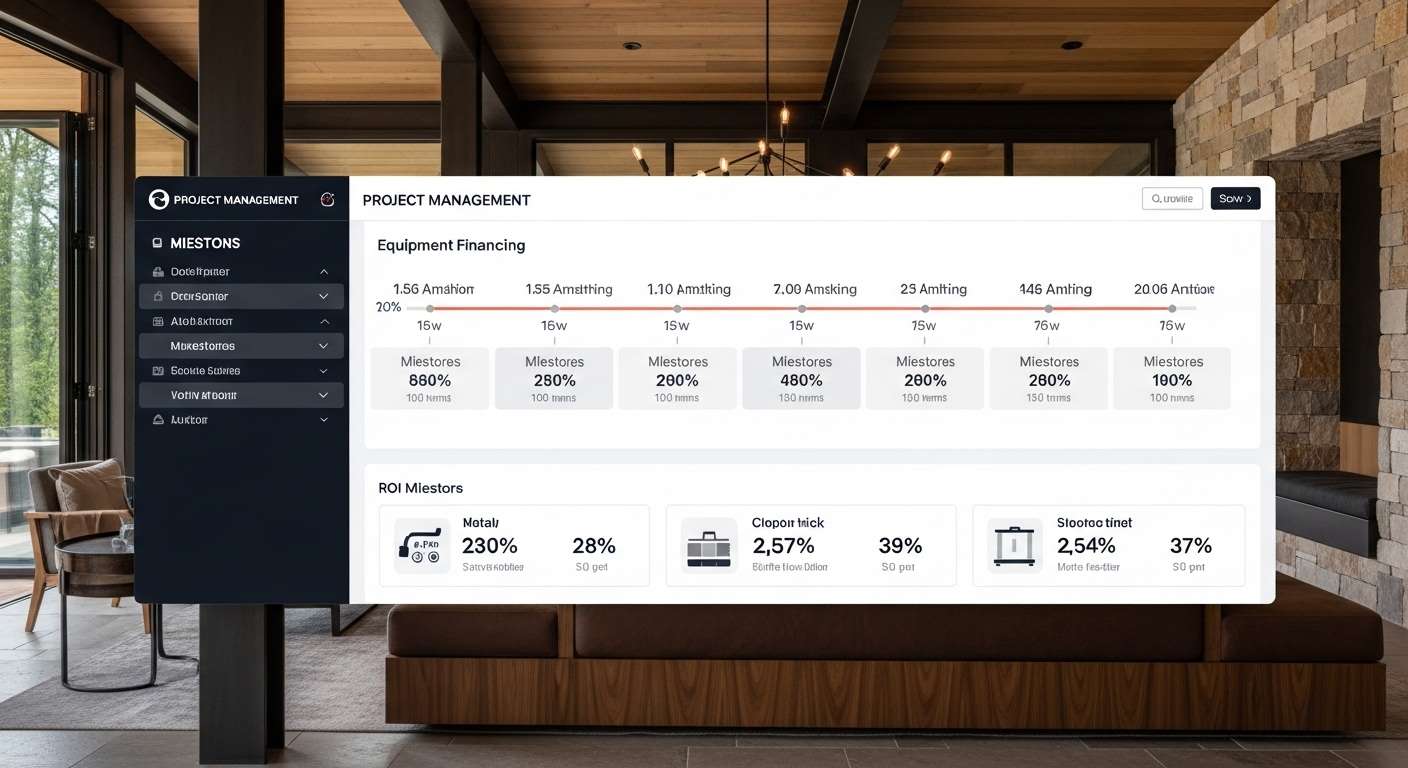

Implementation Timeline and Milestones

Successful equipment financing requires systematic execution with clear milestones and accountability measures.

Phase 1: Strategic Assessment (Weeks 1-2)

Current equipment audit: Document age, condition, utilization rates, and maintenance costs for all existing equipment. Identify replacement priorities based on reliability, efficiency, and safety concerns.

Capacity gap analysis: Compare current equipment capabilities with projected project requirements over the next 24-36 months. Factor in planned business growth and potential new service offerings.

Financial baseline establishment: Calculate current equipment-related costs including payments, maintenance, fuel, and operator wages. This baseline enables accurate ROI calculations for new investments.

Phase 2: Market Research and Vendor Evaluation (Weeks 3-4)

Equipment specification development: Define exact requirements based on your typical project profiles. Avoid over-specifying equipment that won't utilize advanced features, but ensure capabilities match your quality standards.

Financing option comparison: Obtain quotes from multiple lenders including banks, equipment manufacturers, and specialized equipment financing companies. Compare not just rates, but terms, flexibility, and service quality.

Total cost modeling: Build comprehensive financial models for each major equipment investment, including acquisition costs, operating expenses, maintenance, and eventual disposal value.

Phase 3: Decision Framework Application (Week 5)

ROI threshold establishment: Set minimum ROI requirements for equipment investments. Most successful builders require 25-35% annual returns on equipment investments to justify the capital deployment.

Risk assessment completion: Evaluate each investment against your risk tolerance, considering factors like technology obsolescence, market demand changes, and competitive pressures.

Portfolio balance optimization: Ensure your equipment mix supports your strategic business objectives without creating excessive concentration in any single equipment category.

Performance Monitoring and Optimization

Equipment financing success requires ongoing monitoring and adjustment based on actual performance versus projections.

Key Performance Indicators

Equipment utilization rates: Track actual usage hours versus projected utilization. Equipment used less than 60% of projected hours may indicate over-investment or market changes.

Revenue per equipment hour: Calculate the revenue generated per hour of equipment operation. This metric helps identify your most profitable equipment investments and guides future decisions.

Maintenance cost trends: Monitor maintenance expenses as percentage of equipment value. Costs exceeding 15% annually often signal replacement timing.

Project timeline impact: Measure how equipment investments affect project completion times and client satisfaction scores.

Continuous Optimization Strategies

Seasonal adjustment protocols: Develop procedures for scaling equipment capacity up or down based on seasonal demand patterns without penalty costs.

Technology upgrade pathways: Establish criteria for equipment upgrades that balance technological advancement with financial efficiency.

Portfolio rebalancing schedules: Quarterly reviews of equipment mix ensure alignment with evolving business strategy and market opportunities.

The builders who master equipment financing as a strategic tool rather than a necessary evil consistently outperform their competitors in both growth rate and profitability. Your equipment decisions today determine your competitive position tomorrow.

Ready to transform your equipment financing from a cost center into a profit driver? Our financial optimization specialists help luxury builders develop custom equipment investment strategies that accelerate growth while protecting cash flow. Schedule your strategic equipment financing consultation today and discover how the right capital deployment framework can add $500K+ to your annual profits.